It's particularly the service charges I've seen are the current problem, the other two were in the past but some legislation has caught up (though a host of properties exist with short leases and ground rents still, those I wouldn't touch). Any views on part / share of freeholds, given I've mentioned I'm looking around London and whole freeholds are not cheap? The first obvious thing is who you share it with and that relationship needing to be tight (might be a better thread for this, don't wish to derail the chat though I'm intrigued to see what policies both parties come up with on housing for the GE)

(Agreed this is a tangent that is best elsewhere but will post here until it finds/is moved to the right place)

I’ve involvement in a couple of leaseholds so will give a few thoughts. Given from the perspective of a non owner-occupier it’s a sensitive subject, but any insight could be of use going forward.

Firstly, I mentioned the age of leasehold developments previously. The main reason for this is (unfortunately) 1 + 2 bed urban flats have prime rental appeal, meaning they are sold predominantly to investors looking for high yields with minimal effort and owner-occupiers are buying against against that cash-heavy tide. The value of those properties is subsequently determined by the yield. The potential owner-occupier is priced out or forced to pay an inflated price predetermined by an investor.

An added danger here is new developments (off-plans are next level and to be approached with extreme caution) are always sold with minimal ground rent and maintenance charges which artificially inflate the yield attracting investors, and the low costs are appealing to owner-occupiers. Those low charges are presented (misrepresented) as indicative of new-build efficiency and low anticipated ongoing maintenance costs. Once all units are sold the maintenance contracts are rapidly traded and can be bounced many times in the early years before eventually ‘settling down’. Needless to say the charges will invariably have skyrocketed and the service deteriorated with serious consequences for those on wafer thin margins.

(Worth pointing out here this is why so many of recent buy-to-leters, sucked in by the shiny new city centre flats with dreams of a property portfolio are now absolutely f*cked. The yields were a misrepresentation eroded by costs alone and interest rate rises providing an additional punishment beating. We could get into the affects of Stamp duty and Capital Gains Tax changes on additional properties too, but it’s probably best to get back to owner-occupiers for now (no opinion of any sympathy given or expected, or the rights and wrongs of any of this btw)).

As for the leasehold experience, once the costs have stabilised a little you can only hope you have a reasonable company and savvy group of leaseholders holding them to account, with robust communication and meetings at your AGM etc. It’s imperative the issuing of contracts is scrutinised and you are getting value for money. If you are in a shared leasehold arrangement you need to be sure you are all on the same page and are accomplished when authorising works or issuing contracts.

On this note, I’ve had involvement in ex-council leaseholds which can represent extremely good value price wise, with high yields due to lower purchase prices, traditionally low ground rents and maintenance charges. HOWEVER, when it comes to repairs, communal areas etc you will have no say who the contracts are awarded to and be forced to pay your share. Bear in mind it is very galling when you know the repairs are not sensibly priced or sourced, AND, it’s is only the leaseholders that will pay, the council being leaseholder for the properties still tenanted through them.

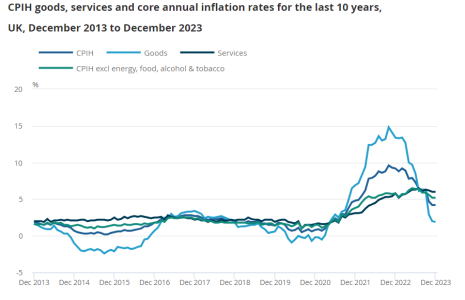

One last thing, the leasehold aspect at purchase might seem a necessary but manageable evil. But it will rapidly grow disproportionately going forward and is really something to think about. Your mortgage will by and large stay the same (interest fluctuations accepted), and in fact in real terms, assuming pay-rises, inflation erosion etc, your overall % of dedicated salary to it will come down. The leasehold maintenance charges are exposed to increases forever, just as your rent once was and so the ratio of mortgage to leasehold charge will only go one way. The awareness and irritation of that quickly grows far beyond the small seemingly manageable seed it starts with.

You’ll always have the psychological aspect of being referred to as the ‘Leaseholder’ and not as an ‘Owner’ too, and some of the conditions and restrictions imposed will serve as a reminder from time to time. Granted the freedom feels huge relative to renting, but as we’re throwing everything out there it’s another one of those things worth considering.

Anyway, hope that might be of some sort of use. I understand due to location you might have no choice but to go LH, but at least there’s a bit of food for thought there . Last thing, don’t forgot despite reservations it can work. A lot of people do so without too much bother so I guess it’s just about picking a route though and having your eyes wide open.

I don’t envy you the challenge but it will be worth it. Good luck!